dependent care fsa income limit

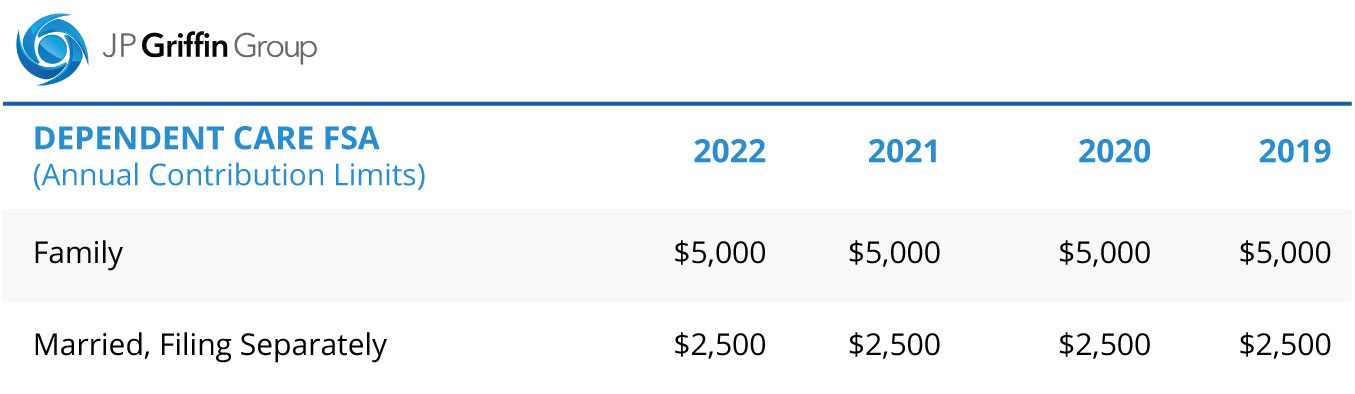

2500 married filing separately 2022 commuter parking and transit. 3 rows employees in 2022 can put up to 2850 into their health care flexible.

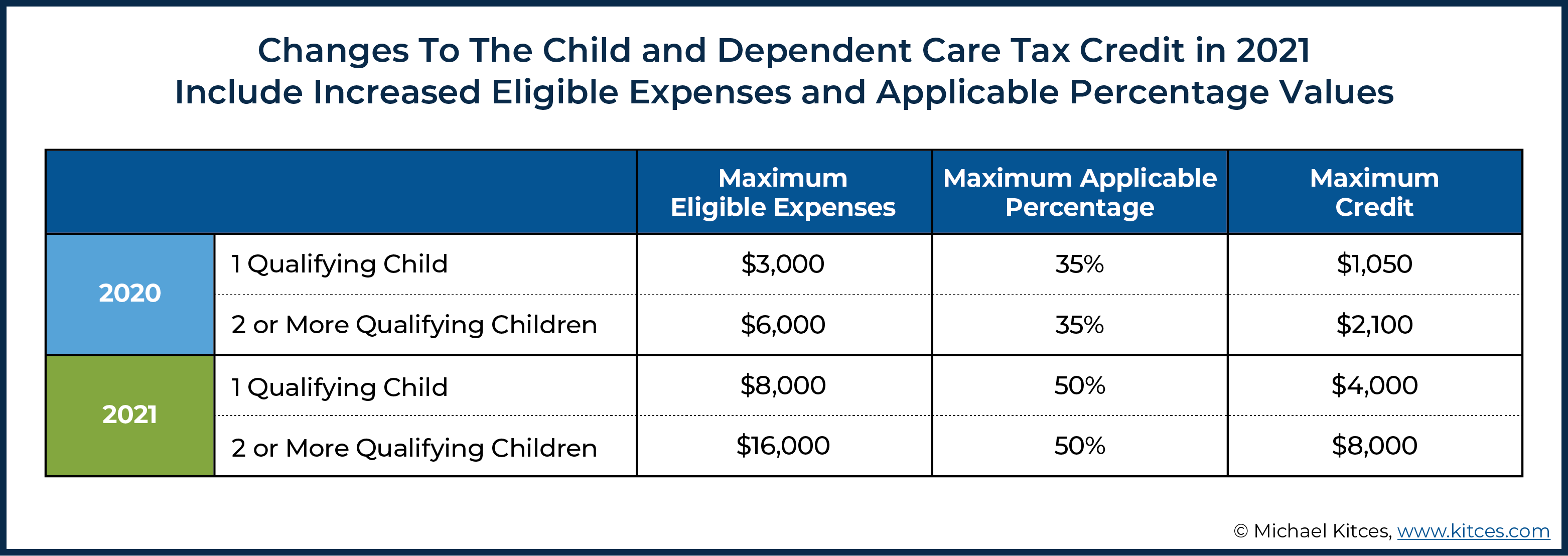

Child Care Tax Savings 2021 Curious And Calculated

If you are married the earned income limitation is the lesser of your salary excluding contributions to your Dependent Care FSA or your spouses salary IRS annual contribution limit for 2022.

. So while the maximum allowed under a Dependent Care FSA is 5000 you may be able to apply the Child and Dependent Care Tax Credit for amounts over that limit up to your tax credit limit depending on your tax situation. Filing jointly your annual limit is. For 2022 and beyond the limit will revert to 5000.

If you are single the earned income limitation is your salary excluding contributions to your Dependent Care FSA If you are married the earned income limitation is the lesser of your salary excluding contributions to your Dependent Care FSA or your spouses salary. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500. As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately.

The maximum amount you can contribute to the Dependent Care FSA depends on your marital status your tax-filing status and income. Dependent Care Fsa Limit 2022 Income Limit. In 2021 the dependent care fsa limit was increased to 10500 for.

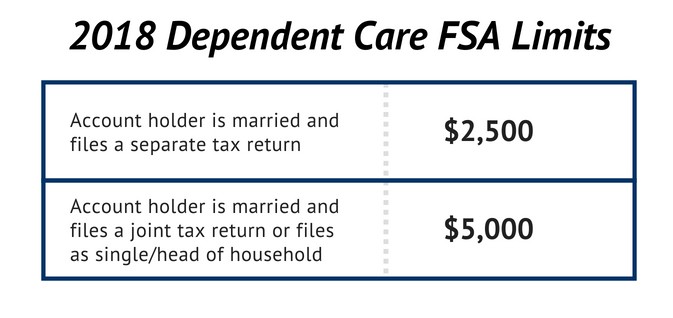

As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately. Filing separately your annual limit is 2500 per each spouse. That means for a married couple each parent can contribute 2500 to their own Dependent Care FSA for a total of 5000.

Dependent Care Flexible Spending Accounts FSAs also known as Dependent Care Assistance Programs DCAP allow you to use pre-tax dollars to pay for qualified dependent day care expenses to enable you to work. Last updated March 29 2021 907 PM Dependent care FSA limit when spouse is highly compensated employee My spouse is categorized as a highly compensated employee and his company says the maximum amount he can set aside for Dependent Care FSA DC FSA is 575. Dependent Care Fsa Limit 2022 Hce Mihanstore from wwwmihanstoreinfo.

ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. Since FSA contributions are pre-tax you save money by not paying taxes on your contributions. ARPA automatically sunsets the increased dependent care FSA limit at the.

FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 5700. ARPA Dependent Care FSA Increase Overview. The 2021 dependent-care fsa contribution limit was increased by the american rescue plan act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples.

Dependent care fsa limit 2022the carryover limit is an increase of 20 from the 2021 limit 550. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. The DC-FSA annual limits for pretax contributions increased to 10500 up from 5000 for single taxpayers and married couples filing jointly and.

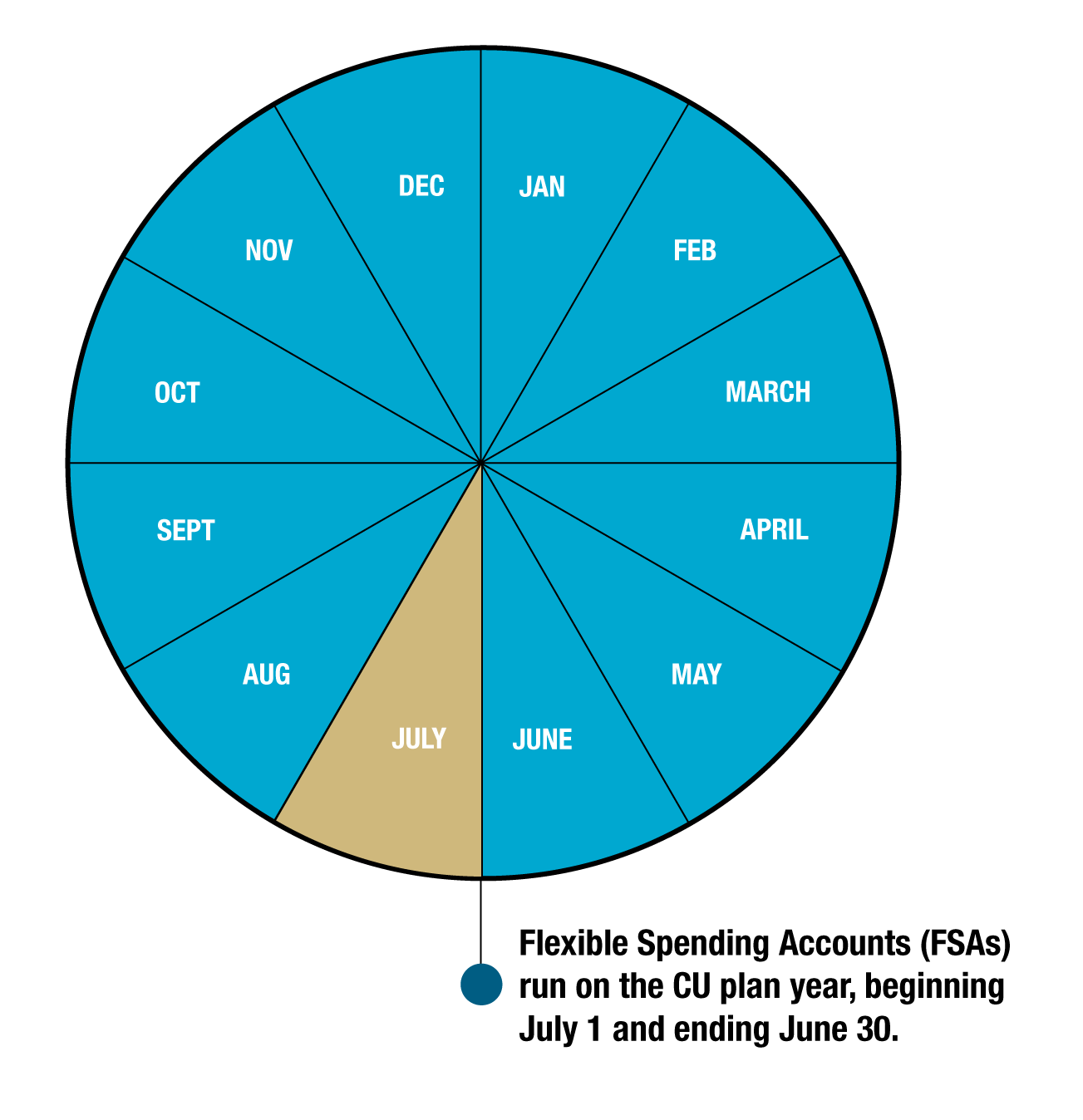

These limits apply to both the calendar year January 1December 31 and the plan year July 1June 30. For the 2021 income year it is 2750 26 usc. The irs does limit the amount of.

Employers can choose whether to adopt the increase or not. Dependent care fsa limit 2022. The internal revenue service irs has announced an increase in the flexible spending account fsa contribution limits for the.

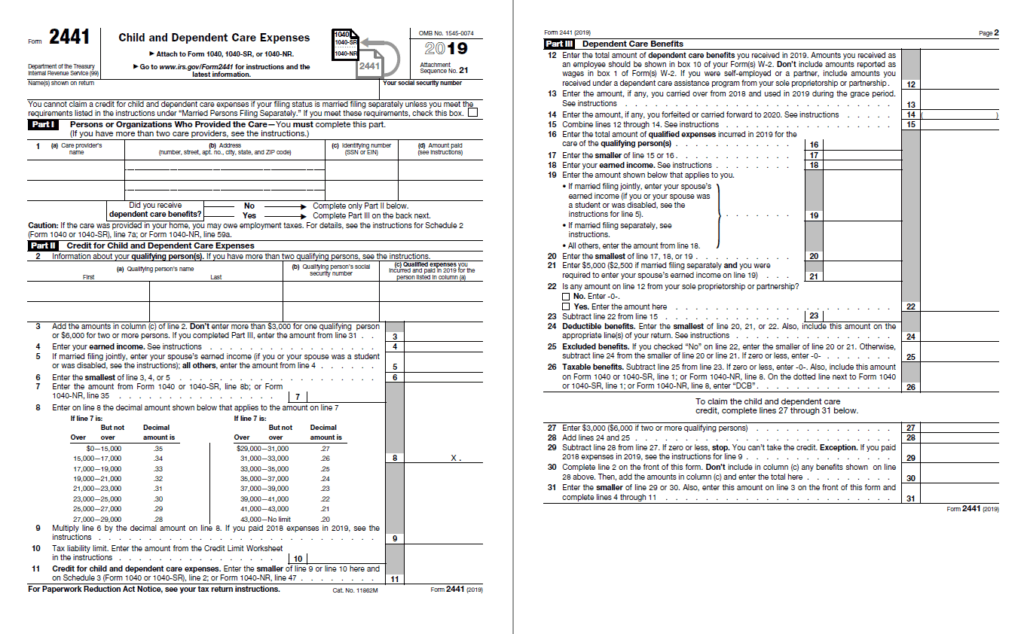

The amount of the credit is based on your adjusted gross income and applies only to your federal income taxes. 5000 per year per family if your 2021 earnings were less than 130000 3600 per year 300 per month per family if your 2021 earnings were 130000 or more Your earned income for the plan year or Your spouses earned income for the plan year. Single file as head of household 5000 Married file a joint return 5000 Married file separate returns 2500.

On november 10 2021 the internal revenue service irs announced that employees can put aside up to 2850 into their health care flexible spending accounts health. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately. For the 2021 income year it is 2750 26 usc.

Dependent Care Fsa Limit 2022 Per Family. Can we still contribute a maximum of 5000 if we are married and filing jointly. Dependent Care FSA Increase Guidance.

Dependent Care Fsa Limit 2022 Married Filing Separately Home from wwwhome-maintenanceinfo A120 sahid nagar bhubaneswar pin. Dependent Care Fsa Limit 2022 Irs from wwwnovasiriinfo. The carryover limit is an increase of 20 from the 2021 limit 550.

For 2021 the arp increased the maximum amount that can be excluded from an employees income through a dependent care assistance program to 10500 5250 if married filing separately. As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately. The savings power of this fsa.

As set by the internal revenue code the dependent care fsa limits for 2022 are 5000 for married filing jointly or single and 2500 for married filing separately. The guidance also illustrates the interaction of this standard with the one-year increase in the exclusion for employer-provided dependent care benefits from 5000 to 10500 for the 2021 taxable year under the American Rescue Plan Act.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

What Is A Dependent Care Fsa Wex Inc

The Benefits Of Offering Employees A Dependent Care Fsa Er

What To Know About Dependent Care Fsas And Saving Money On Childcare Real Simple

Dependent Care Benefits Overview Criteria Types

Child And Dependent Care Expenses Credit Youtube

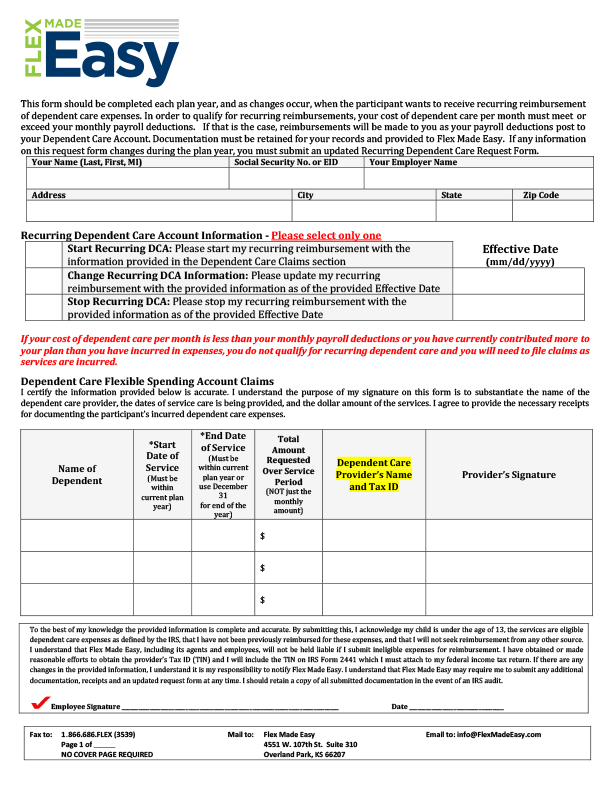

Dependent Care Flexible Spending Accounts Flex Made Easy

What Is A Dependent Care Fsa How Does It Work Ask Gusto

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

You Can Get Up To 8 000 In Child And Dependent Care Credit For 2021 Forbes Advisor

What Is A Dependent Care Fsa Wex Inc

Dependent Care Fsa University Of Colorado

What You Need To Know Before Getting A Dependent Care Fsa Account

What Is Fsa Dependent Care Workest

Why You Should Consider A Dependent Care Fsa